WHEFA Overview

WHEFA Overview

WHEFA, created by the Wisconsin legislature in 1973 (Chapter 231, Wisconsin Statutes), has been providing active capital financing assistance to Wisconsin nonprofit health care organizations since 1979. Over the years, the Wisconsin legislature has expanded the types of nonprofit entities eligible for WHEFA financing assistance from just hospitals and other health care entities, to also include independent colleges and universities, certain continuing care facilities, private elementary and secondary schools, research facilities, and community rehabilitation providers. WHEFA’s charter now allows all 501(c)(3) nonprofit organizations with a project in Wisconsin access to WHEFA’s low-cost capital financing.

WHEFA, created by the Wisconsin legislature in 1973 (Chapter 231, Wisconsin Statutes), has been providing active capital financing assistance to Wisconsin nonprofit health care organizations since 1979. Over the years, the Wisconsin legislature has expanded the types of nonprofit entities eligible for WHEFA financing assistance from just hospitals and other health care entities, to also include independent colleges and universities, certain continuing care facilities, private elementary and secondary schools, research facilities, and community rehabilitation providers. WHEFA’s charter now allows all 501(c)(3) nonprofit organizations with a project in Wisconsin access to WHEFA’s low-cost capital financing.

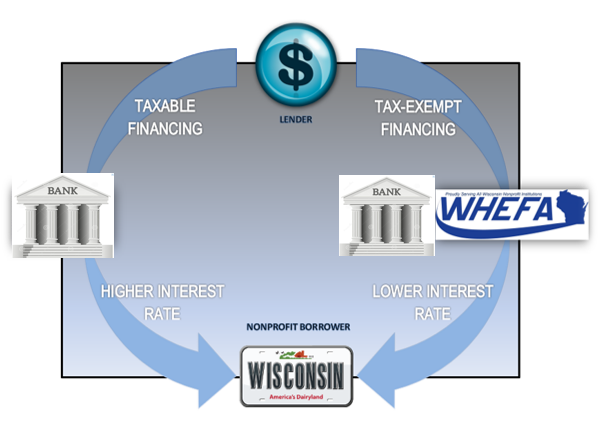

Funds for each project financed by WHEFA are obtained through the sale of revenue bonds of WHEFA. Bonds are sold to institutional lenders in “direct placement” transactions and to individual and institutional investors in “public offerings”. Bond sale proceeds are loaned by WHEFA to the borrowing organization or project sponsor. No state or other public funds are used.

WHEFA’s bonds are payable solely out of loan repayments from the borrowing organization, sponsor or guarantor. The bonds are not a debt, liability, or “moral” obligation of the State of Wisconsin or any of its political subdivisions. WHEFA has no taxing power.

The credit supporting any WHEFA bond issue is the credit of the borrowing entity involved. The availability of financing and its terms and conditions depends in each case upon the credit-worthiness of each borrower. Interest paid on WHEFA bonds is exempt from federal income taxation, resulting in materially lower financing costs to the borrowing organization. Interest on certain bonds issued by WHEFA is exempt from present Wisconsin income taxation.

We strive to make the WHEFA process as streamlined as possible. For existing WHEFA borrowers wishing to only refinance outstanding debt, there is no application required. For existing WHEFA borrowers with new money projects and first time WHEFA borrowers, there is a very brief one-page application that needs to be completed.

The Benefits of WHEFA

WHEFA is an advocate, educator and resource for all nonprofit organizations in Wisconsin looking to finance qualifying capital projects. The staff assists all nonprofit organizations in a variety of ways, which may include:

- Providing a Federal tax-exemption on all eligible financings and a State tax-exemption on certain financings.

- Providing front-end financing assistance when borrowers are deciding among financing alternatives.

- Imparting the knowledge and experiences from one transaction to another.

- Expediting the financing process.

- Having the ability to issue one series of bonds for multiple locations (including other states).

- Providing educational assistance through newsletters and conferences.

- Offering assistance in the determination of eligibility for tax-exempt financing.

- Advocating at both the federal and state level for the continuation and improvement of the tax-exempt financing process.

- Maintaining professional competence through membership in the National Association of Health & Educational Facilities Finance Authorities (NAHEFFA).

ABOUT WHEFA

CONTACT US

WISCONSIN HEALTH & EDUCATIONAL FACILITIES AUTHORITY

18000 W. Sarah Lane, Suite 300

Brookfield, WI 53045-5841

262.792.0466